The construction industry's stability is intricately linked to the cost of raw materials, particularly steel products like rebar, I-profiles, galvanized flat steel, and angles. These materials not only impact the stability and safety of structures but also influence construction costs significantly.

During economic downturns, the iron and steel market tends to remain stable, prompting strategic purchases of steel sections. Conversely, construction booms drive up demand for products such as I-beams, rebar, and angles, consequently leading to higher prices. However, predicting future iron and steel prices becomes challenging due to fluctuations in currency markets, which can disrupt traditional analyses.

In Iran, iron and steel prices are heavily influenced by the housing market's dynamics, including fluctuations caused by recent recessions and currency volatility. Liquidity shortages have led to reduced demand, resulting in price reductions and deferred purchases of steel sections. Moreover, iron ore prices play a pivotal role, with increased demand affecting all steel sections and contributing to a recent upward price trend.

Looking ahead to Iranian year 1403 (2024), iron prices are expected to rise due to fluctuating exchange rates and various economic factors such as budget deficits, higher gasoline prices, reduced oil revenues, ongoing sanctions, and decisions related to steel section supply in the stock market. The recent surge in the dollar rate, surpassing the 59,000 rials threshold, has prompted a shift in direction, leading to price increases.

Factors such as supply and demand, global prices, inflation, and economic conditions further influence iron and steel prices in Iranian year 1403(2024). However, predicting these prices remains challenging due to exchange rate fluctuations exacerbated by current conditions and government contractionary policies.

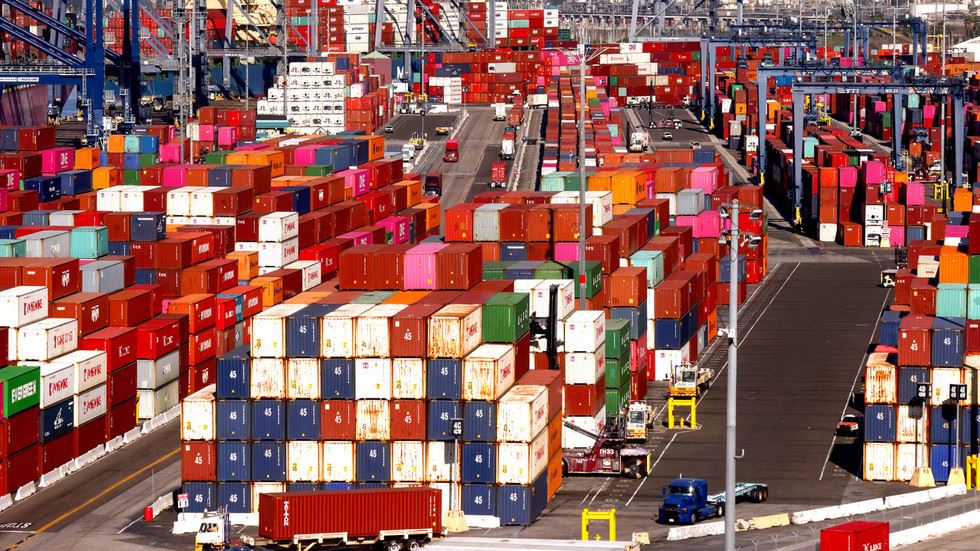

Export tariffs on steel products are directly linked to exports, resulting in price hikes. The Middle East crisis has extended export tariffs due to longer shipping routes, subsequently driving up prices and export duties for steel products. Insecurity affecting transportation routes and exports has led to longer shipping times, while increased oil export tariffs have also contributed to higher prices for oil and steel products like colored sheets.

On a global scale, the World Steel Association anticipates a 1.9% growth in global steel demand in 2024, reaching 1,849.1 million tons. This growth is fueled by China's improved construction sector, potentially leading to higher prices in the upcoming year.

In a recent government announcement, export duty rates for raw and semi-raw materials for fiscal year Nisan 1403 (Mart 2024) have been reaffirmed, echoing a resolution passed in March 1402 (2024). The approved rates aim to maintain stability and continuity for exporters, facilitating their planning for the year ahead. These rates encompass various steel chain products, including Magnetite Iron Ore at 20%, Hematite Iron Ore at 2%, Iron Ore Concentrate at 5%, Iron Ore Pellets at 2%, Sponge Iron at 5%, and Steel Billets, Blooms, and Slabs at 1%. By upholding consistency with previous resolutions, the government seeks to provide predictability and support to businesses engaged in the export of these crucial materials.

The latest report from the World Steel Association highlights the robust growth in global steel production during February 2024. A staggering 148.8 million metric tons of steel were produced worldwide in that month alone, marking a notable upsurge. Comparing February 2024 to the same period in the previous year, there's a remarkable 3.7% increase in global steel production. This upward trajectory extends to the cumulative output for January and February 2024, which reached an impressive 306.9 million metric tons, reflecting a commendable 3% surge compared to the corresponding period in the previous year. Within this global surge, Iran emerges as a significant contributor, with its steel production in February 2024 reaching 2.2 million metric tons. This represents a growth rate of 14.3% compared to February 2023. Moreover, when considering the combined production for January and February, Iran's steel industry exhibited a remarkable 26.5% increase compared to the same period in the previous year, reaching 4.8 million metric tons.

Comments

No comment yet.